One trusted partner

Banking, capital, cards, bill pay, and finance operations all in one platform—to save you time and money.

Higher yield, better Bill Pay, and an AI-powered financial command center. All in one platform.

Highbeam is a financial technology company, not a bank.

Banking services provided by Thread Bank, Member FDIC.

.png)

.png)

.png)

Banking, capital, cards, bill pay, and finance operations all in one platform—to save you time and money.

Agents that automate scenario planning, treasury, bookkeeping and more. It's your finance team that never sleeps.

Access our best-in-class services, customized for you, and connect with exclusive, top-tier financial partners.

Highbeam Intelligence gives you expert agents that automate important, manual finance tasks to save you time through automated scenario analysis, treasury, reporting, and more.

See Highbeam Intelligence in action

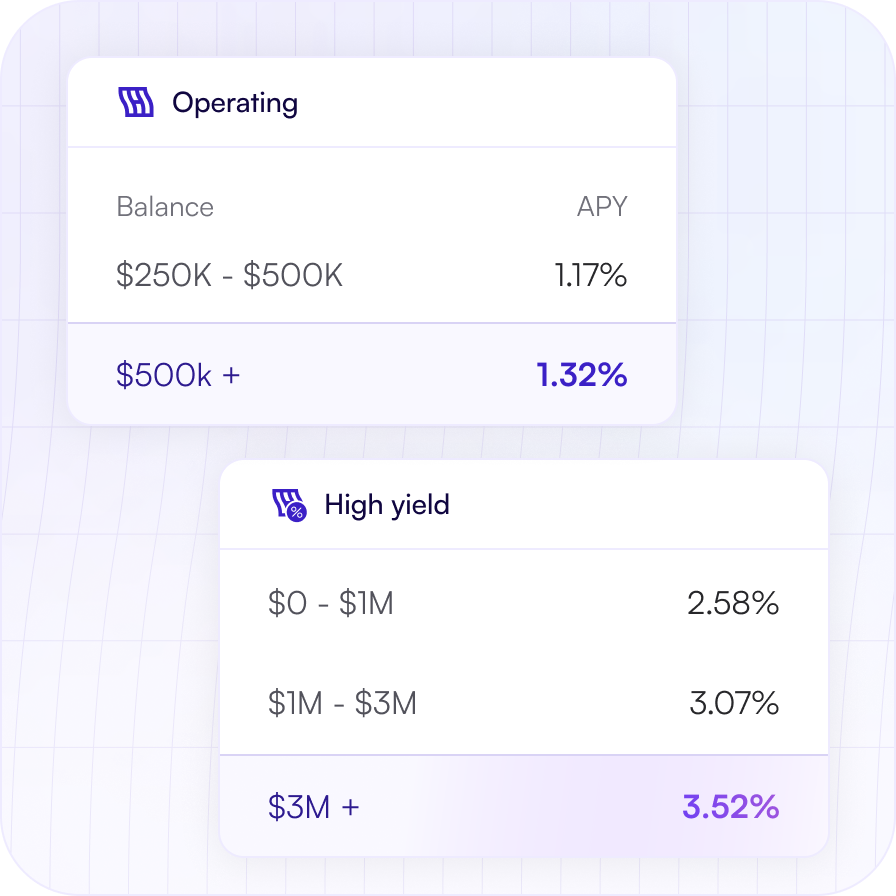

Maximize your returns with competitive yields on checking and savings, automatically optimized with $3M FDIC insurance on deposits through Thread Bank, member FDIC, for total peace of mind.

Learn more about banking

Whether it's a revolving line of credit, a cash advance, or a custom solution, we provide flexible terms and transparent rates tailored to your brand's needs.

Discover Highbeam Capital

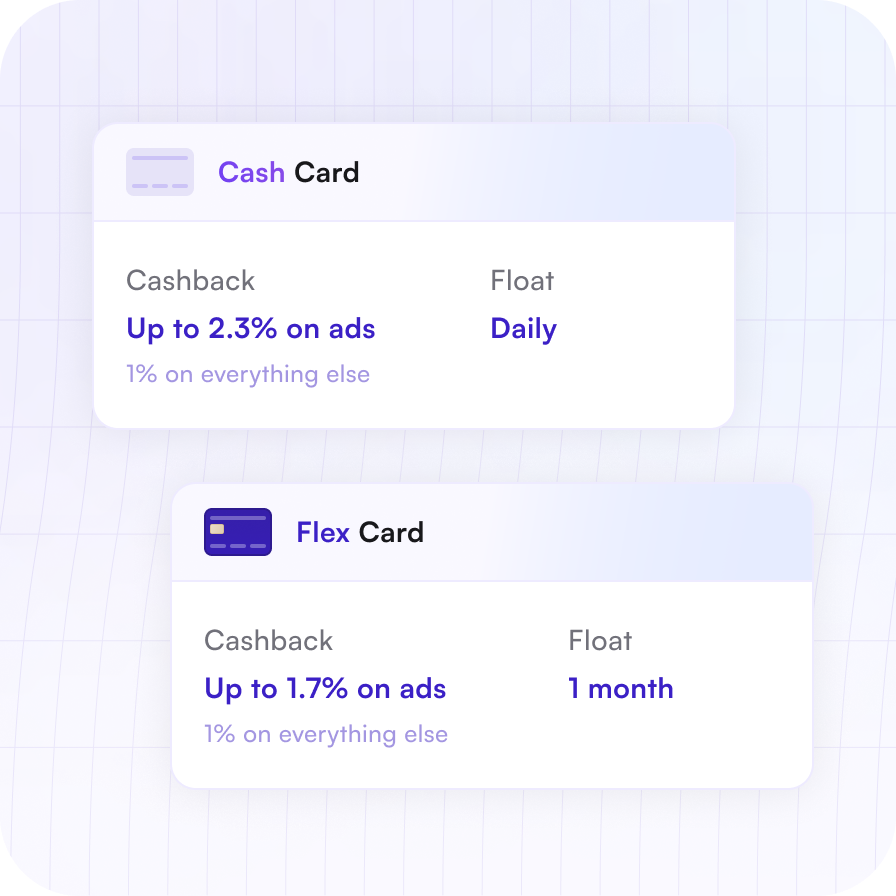

Choose between cash back up to 2.3% or extended repayment options.4 Simplify spend management and keep your focus on growth.

Check out the Highbeam Card

Integrated bill pay lowers costs, boosts security, and automates manual tasks, so you can pay vendors quickly and confidently.

Simplify with Highbeam Bill Pay

.avif)

Before Highbeam, the cash flow drove the strategy instead of the business. Highbeam put us back in control.

Lauren Goldberg

CEO, Suzie Kondi

Highbeam stands next to me, providing a safety net and a transparent line of credit. Unlike a debt provider, I know we can build together for the long run.

Mickey Ashmore

Founder and CEO, Sabah

I strongly believe founder finances are just too complicated. Highbeam solves a genuine need by providing the financial organization that enables me to control my own business.

Suzanne Lehrer Dumaine

Founder and CEO, Stocked by Three Owls

Growth is hard. Sustainable, profitable growth is much harder — and it's here that Highbeam can be a game changer for brand founders.

Ricky Joshi

Co-founder and CSO, Saatva

Waiting a month for accounting close to manage spend just wasn't good enough. Highbeam lets us see where our money is going in real-time which is invaluable.

Sib Mahapatra

Co-founder, Branch Furniture

Before modern entrants like Highbeam, you were stuck with traditional banks that don't understand your business or institutional startup banks that may not deliver on what you need. For emerging brands, Highbeam makes a lot of sense.

David Whitcroft

Head of Consumer and CFO, Full Stack Finance

Highbeam allows me to manage my business cash flow in real-time. These insights help me save what matters most—time and money.

Maurice Mosseri

Co-founder, Still Here

My old bank had a user experience from a decade ago and I had to wait on hold for an hour to talk to anyone. Highbeam understands my business, and someone is always available. Switching was a no-brainer.

Jimmy Lin

Founder and President, Heat Press Nation

Highbeam has been a great asset to VADA's growth. Samir and his team have been extremely helpful with financial planning and funding. We love how easy it is to do business internationally using Highbeam.

Katie Caplener

Founder and Designer, Vada Jewelry

Highbeam's high interest savings account puts my extra cash to work while still giving me instant access to it. It's a win-win.

Adrian Alfieri

Founder, Verbatim Labs

.avif)

Highbeam is not only a best-in-class banking platform for ecommerce brands but it also drastically improved how we manage and plan our finances.

María Romero

Founder, Tintorería

Highbeam's cash flow tools have added efficiencies to my weekly cash management process saving both time and money.

Doreen Deymen

Controller, Tushy

Highbeam helps you predict and forecast when and where you might need capital next, then it helps you access it, all within the same platform, with much lower rates.

Nik Sharma

CEO, Sharma Brands

It's a massive relief to know that there's someone that has my back financially. With Highbeam in my corner, I can focus on building Sabah in a thoughtful way.

Mickey Ashmore

Founder and CEO, Sabah

Highbeam saves us thousands every month. Managing our finances is so much easier now, and the personal service is just top-notch.

Alex Crane

CEO, Alex Crane

I love Highbeam for it's ease of use—they're not a legacy system where it takes ten minutes to switch pages or create a new wire. Samir and his team have been really supportive and prompt when I've had any issues.

Adam Humphreys

Partner, Labucq

The typical brand using Highbeam makes over $5M in annual sales.

.png)

.png)

.png)

Don't use 7-10 different finance tools. Highbeam puts everything you need into one intuitive platform.

Deposits are FDIC-insured up to $3M through our partner bank, Thread Bank, member FDIC.

When you are a Highbeam customer, you tap into our network of high-growth brands and preferred vendors.

We never use your data without your permission and have enterprise grade security to keep your information safe and secure.

Try our value calculator and get an estimate of the value Highbeam can bring your business.

One integrated platform that automates cash flow management and maximizes profitability.